The $280 Shift in Home Affordability: What It Means for You

The $280 Shift in Home Affordability: What It Means for You

If you’ve been waiting for a better time to buy a home, that moment may have arrived. Recent data shows that affordability is improving across many markets, giving buyers more breathing room and new opportunities.

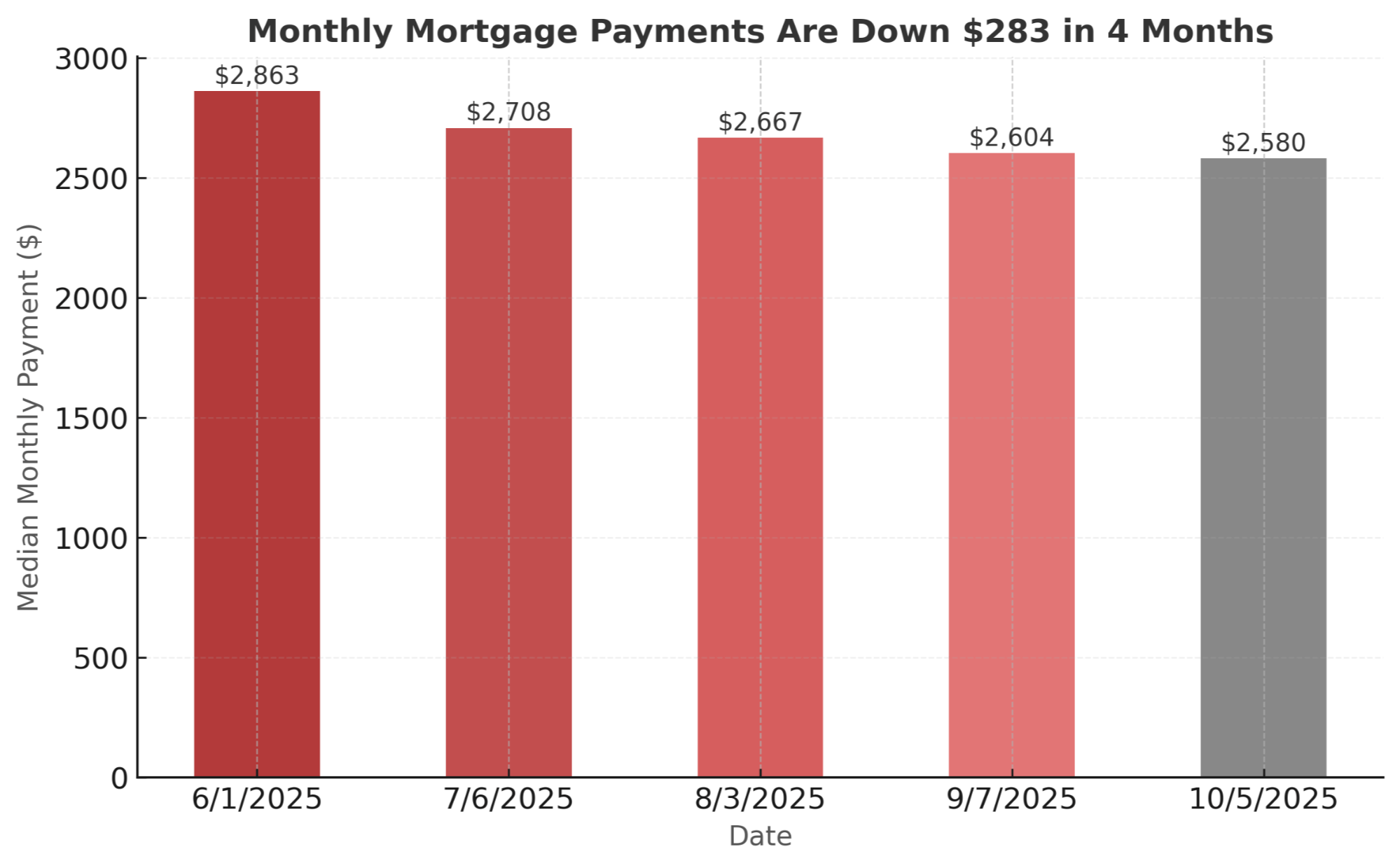

Monthly Payments Are Dropping

According to Redfin, the median monthly mortgage payment has fallen by $283 over the past four months—from $2,863 in June to $2,580 in October 2025. That’s nearly $3,400 in annual savings for the average homeowner.

While this shift doesn’t erase affordability challenges entirely, even a few hundred dollars can make a big difference. It might be the boost that turns your “almost” into a “yes.”

For example, Redfin notes that a buyer with a $3,000 monthly budget can now afford a $468,000 home—about $22,000 more than they could just a few months ago.

What’s Behind the Change?

Two main factors are driving this positive movement:

-

Mortgage rates have eased from their earlier highs.

-

Home price growth is slowing in many regions.

Together, these trends have improved overall affordability—now at its highest point in two and a half years, according to ICE Mortgage Technology.

What It Means for You

Whether you’re a first-time buyer or thinking about upsizing, this shift could make your move possible. Lower payments, improved affordability, and steadier prices all work in your favor.

Bottom Line

Affordability is improving nationwide, and that changes the math on your next move.

If you’ve been waiting for the right time to act, this may be your sign. Let’s review your numbers and explore your options together—you may have more buying power than you think.

Categories

Recent Posts

GET IN TOUCH